Winter of Discontent? What Lies Ahead for Foodservice Sales

Even before the first day of fall, there was a growing chill in the air for foodservice operators. Warm weather and patios gave a much-needed shot in the arm to many foodservice establishments during the summer, yet, business owners are already asking themselves: what’s next?

Will consumers transition to indoor dining once patios close? Will there be another spike in COVID-19 cases in the fall? What government programs will be in place to help the foodservice industry? Can my business survive?

Restaurants Canada’s survey of its members conducted in mid-August echoed many of these issues as we head into the fall season. More than 90% of restaurant operators surveyed expect their total sales volume to be lower between September and November compared to September and November 2019. In contrast, just under 2% expect their sales will be higher.

More worrisome: of those that expect lower sales, 63% believe the drop in sales in the fall will be worse than the declines they experienced in the summer months. In fact, 41% feel it will be “a lot worse”. While many attribute this to the closure of their patios, they also point to the dramatic drop off in business dining. A number of respondents are located in downtown markets across the country, and many companies are not bringing their employees back until 2021. Border closures and restricted travel means operators will depend solely on their local market to keep their business open.

Foodservice Sales Forecast for the Remainder of 2020

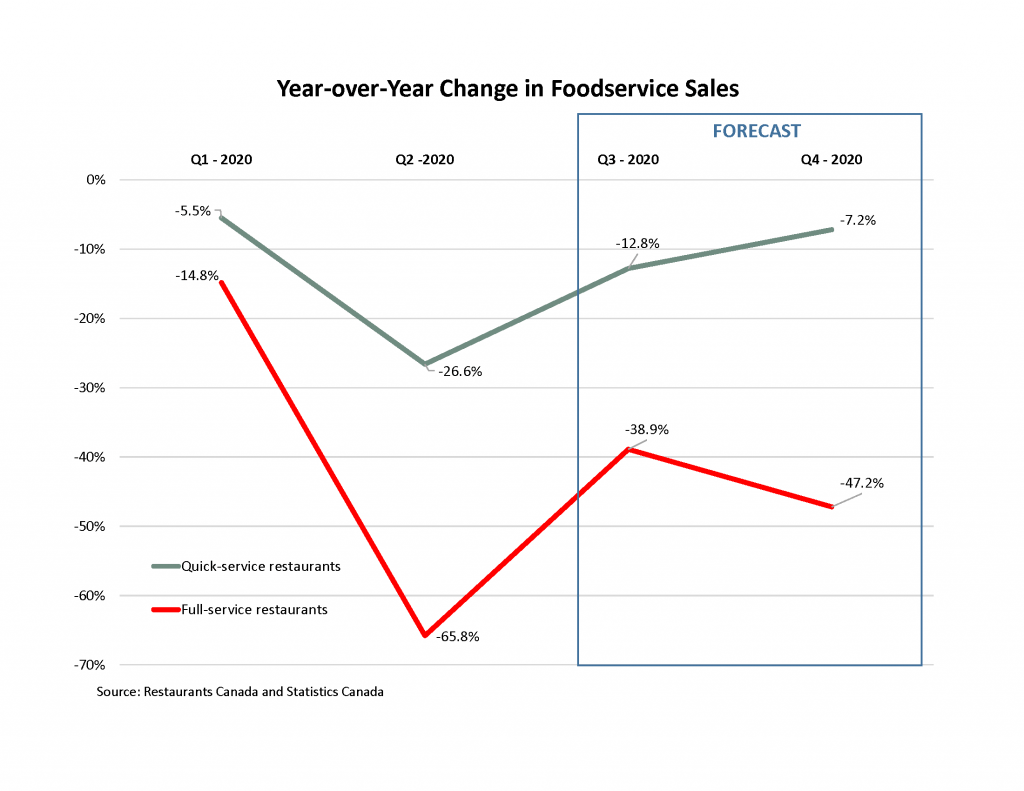

While Statistics Canada has not yet released the sales data, Restaurants Canada is projecting a 12.8% decline in quick-service restaurant sales in the third quarter on a year-over-year basis. This compares to a 26.6% drop in the second quarter. In the fourth quarter, quick-service restaurant sales are forecast to fall by 7.2%.

It will be a significantly longer and uneven recovery for full-service restaurant sales compared to quick-service restaurants. Following a staggering 65.8% decline in the second quarter, full-service restaurant sales are projected to fall by 38.9%. While this still represents a steep drop in sales, patio season and warm summer weather helped bring guests out to restaurants. Rather than a continued improvement, however, patio closures and cooler temperatures will restrain consumer spending in the fourth quarter, with full-service restaurant sales forecast to drop by 47.2%.

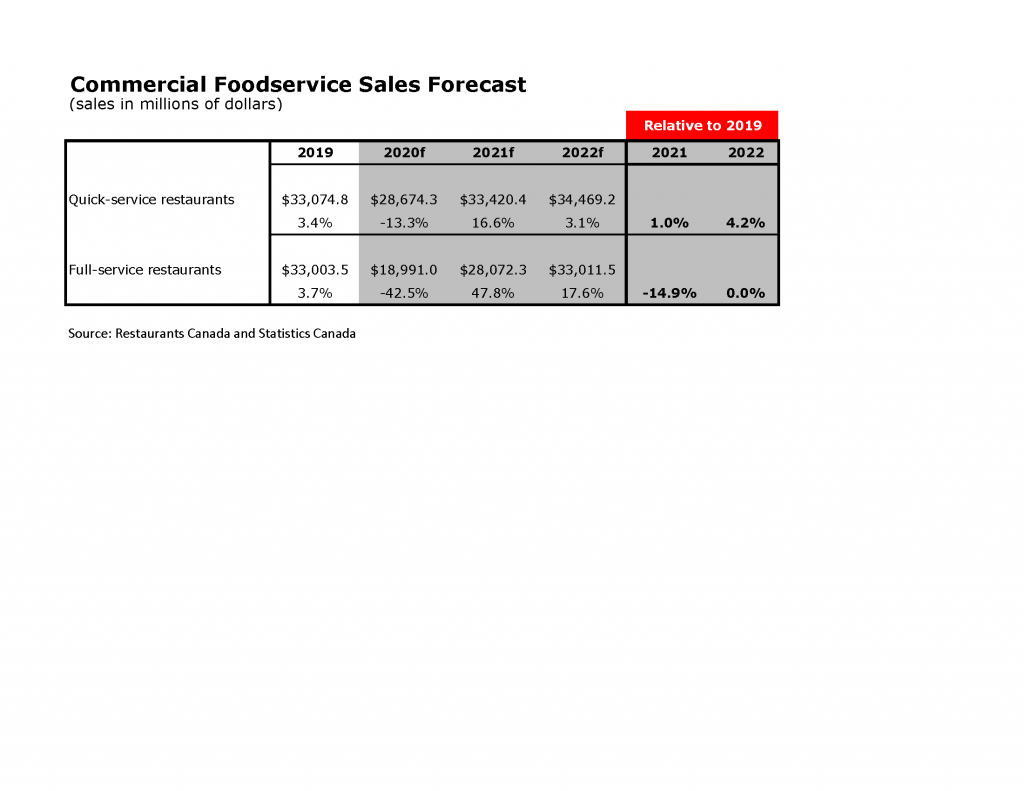

On an annual basis, foodservice sales at quick-service restaurants in 2020 are forecast to be $4.4 billion lower than in 2019. This represents a 13.3% year-over-year drop. In contrast, annual full-service restaurant sales are forecast to plummet by 42.5% in 2020, an astonishing $14 billion lower than in 2019.

Beyond 2020: Sales Forecast for 2021 and 2022

Looking ahead, the road to recovery will continue throughout 2021 and 2022. Quick-service restaurants will fully recover to pre-COVID-19 levels in 2021, finishing 1% above 2019 annual sales levels.

In contrast, full-service restaurants will take longer, as tourism and business dining are not expected to return to pre-COVID-19 levels until 2022 (or later). As a result, annual sales at full-service restaurants in 2021 are forecast to be 14.9% below 2019 levels. In 2022, annual full-service restaurant sales will just barely return to pre-COVID-19 levels.

Forecast Assumptions

The above forecasts depend on several critical assumptions. It is assumed that coronavirus vaccinations will begin in early 2021. Once an effective vaccine is found, pent-up demand will boost domestic spending and international travel. Office workers and businesses in the downtown core will return to some form of “new normal”. However, a delay in finding an effective vaccine would significantly lengthen the recovery time for the foodservice industry.

The forecast also assumes that there is no further national lockdown like the one in April 2020. Another major lockdown would have a devastating impact on foodservice sales and many operators are not likely to survive a second lockdown.

For a detailed foodservice sales forecast by segment by quarter, login to Restaurants Canada’s member and download the Q3 Quarterly Forecast report, free to Restaurants Canada members.

To learn from leading industry experts on what the “next normal” will look like for Canada’s foodservice industry, the 2020 Foodservice Facts is now available free to Restaurants Canada members on the member portal.

Join us on October 7, 2020 for the Foodservice Facts: The Next Normal? webinar as senior economist Chris Elliott takes a deep dive into this report. Secure your spot for this webinar that will help you make informed decisions as your business negotiates the challenging road ahead.